Lessons from a Pandemic: We Are Not Invincible

While it may sound obvious, we all think we are invincible at certain points. Call it youthful ignorance or burying our head in the sand or whatever excuse we may have, but we all think or act like we are invincible at some point. Frankly, it is natural to think that nothing bad could ever happen to us. Other people are mere mortals, but me, I am gonna live forever. Of course, deep down, we all know that is not true, but it is not comfortable to acknowledge that.

COVID-19 reminded us that we are mortal. That we can get sick. We can get severely sick to the point that we need someone to speak for us. And worst of all, we could die. Again, over a half million people died from this sickness that we just learned about last year. It is true that young and, presumably, healthy young people generally survive this sickness, but not everyone does. There again is that feeling that I am not going to be the one that gets sick and dies, it is going to be the other guy.

One thing that we missed out on from the pandemic is Minnesota State University, Mankato Maverick hockey. Our family is a huge supporter of the program and season ticket holders. The “other guy” syndrome that we often see is beautifully illustrated by a promotion that the program does each year. Each year they hold a cancer awareness night. As fans walk into the game, they hand out glow necklaces to everyone. You can see a picture of the arena below that holds 5,100.

Before introducing the starting lineups, all the lights are turned off and the arena is dark. The announcer comes on the loudspeaker and tells everyone to “break” the glowing part of their necklaces and hold it above their head if they have ever been afflicted with cancer. A somewhat small portion of the crowd follows the instructions and the announcer then asks anyone that has a family member that has had cancer to break their necklace and hold it above their head. A larger part of the crowd follows the instructions. Finally, the announcer instructs everyone that knows someone that has been afflicted with cancer to break their necklace and hold it above their head. Inevitably, every person in the crowd is holding a necklace above their head and the entire arena is glowing green.

So, what does this have to do with a pandemic? Well, nothing directly other than we did not have Maverick hockey this year. What it does illustrate is the life is precious. It is NOT always someone else. At some point, it is each of us or it is someone that we love. It means that planning now is important. Intentions are great, but they do not mean anything if we do not follow through and actually complete our planning.

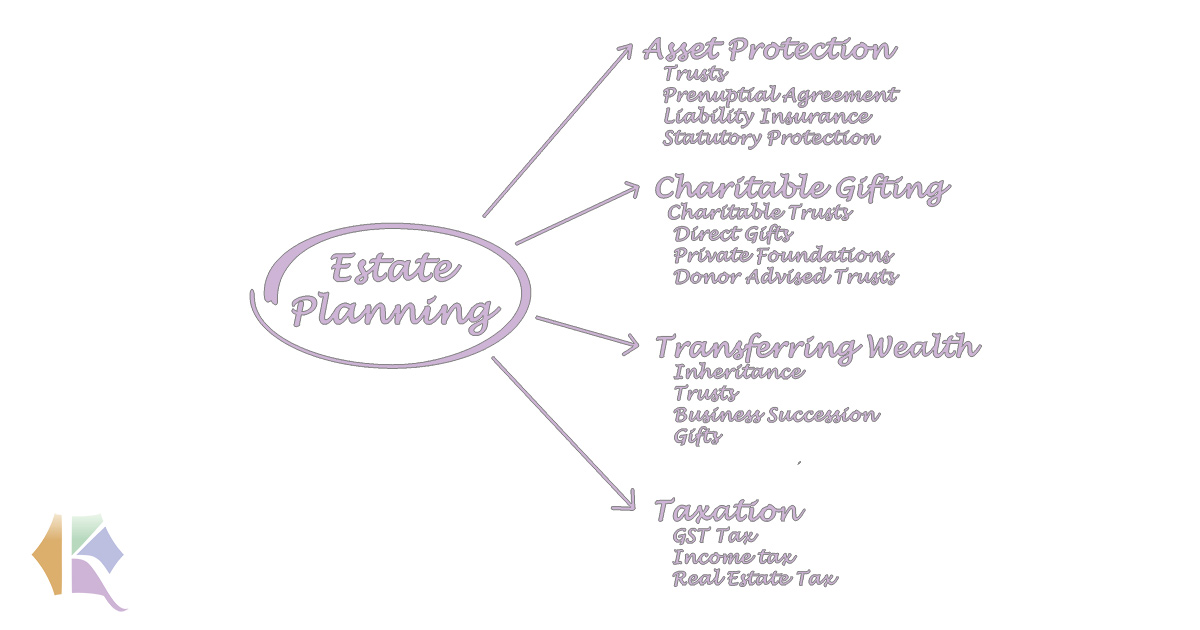

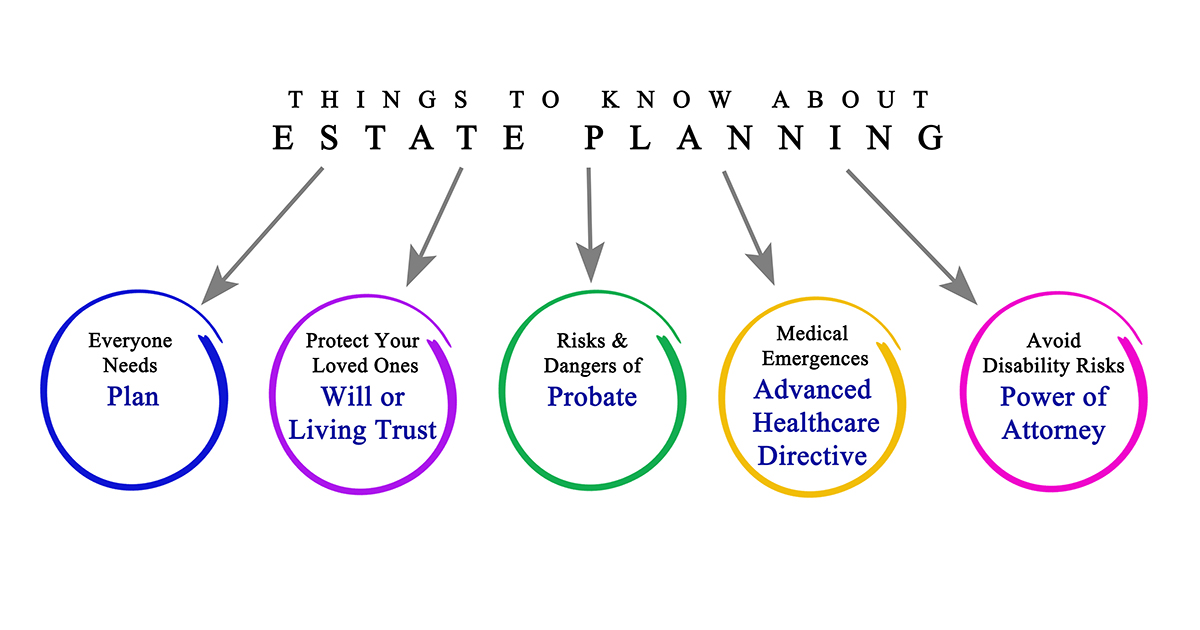

Whether you need a simple will or you need a trust or you need a special needs trust for your children or you need a health care directive for your wishes if something happens to you, a sense of urgency is important. The last thing that any of us wants to hear in the estate planning community is that you had the best of intentions to get it done, but just did not think it could happen to you. Your loved ones will be the ones the suffer the consequences. Our goal is to take away any uncertainty of how your loved ones are taken care of or who is going to take care of them. None of us are invincible, it could be us.