What Does a Charitable Remainder Trust Do?

The last in our series of articles on trusts is a Charitable Remainder Trust, or a CRT. This very specialized trust is typically used by people that are interested in philanthropy. They often want to create a legacy both while they are alive and after they die. They are planning to make donations to their favorite charity, but still need to have money to spend during their life.

In terms of how a CRT works, it is good to go through a primer on how a trust in general works. In simple terms you create the trust, or your box. Then you will title your assets in the name of the trust. From there you will name a trustee, or the person that will put things into the box or take things out of the box. The trustee will have the ability to sell the assets in the box so that it becomes liquid cash. While the person writing the trust (also known as the grantor) is living, they will still get cash to live off. The intent of the trust is to make sure that person is taken care of and will lay out the details of what is expected while the person is still living. Once the grantor of the trust dies, the trustee will then take the assets that are in the box and distribute the proceeds to the specified charity or charities. Obviously, the mechanics of this arrangement are a little more complex, but this is what happens in its simplest form.

You may ask, why would someone want to do this? Why would you create a CRT instead of just “willing” the assets or cash to the appropriate charities? Like any other legal question, there are a many different reasons. We will not get into the details of each of them specifically. The reasons could span from wanting to convert an appreciating asset such as land into lifetime income. From a tax perspective, you may want to reduce or eliminate estate taxes. It’s also possible that you are in a position that you want to decrease your current income taxes with a charitable income tax reduction or you may want to avoid a capital gains tax when selling the asset. You also have the assurance that when you die, you know that your money is going to go to fulfill the objectives that you set. There really is no room for anyone to object to your donation if the trust is set up appropriately.

From the charity’s perspective, they would be in favor of this sort of a plan simply because it helps them to be able to budget in future years. They may not know the exact timing, but they certainly would know the approximate amount that they are set to receive in the future. Once the trust is developed and put into place, they know that can plan on fulfilling the mission of their organization whether it is a medical research group, a church, a scholarship or any other directive that they set out accomplish.

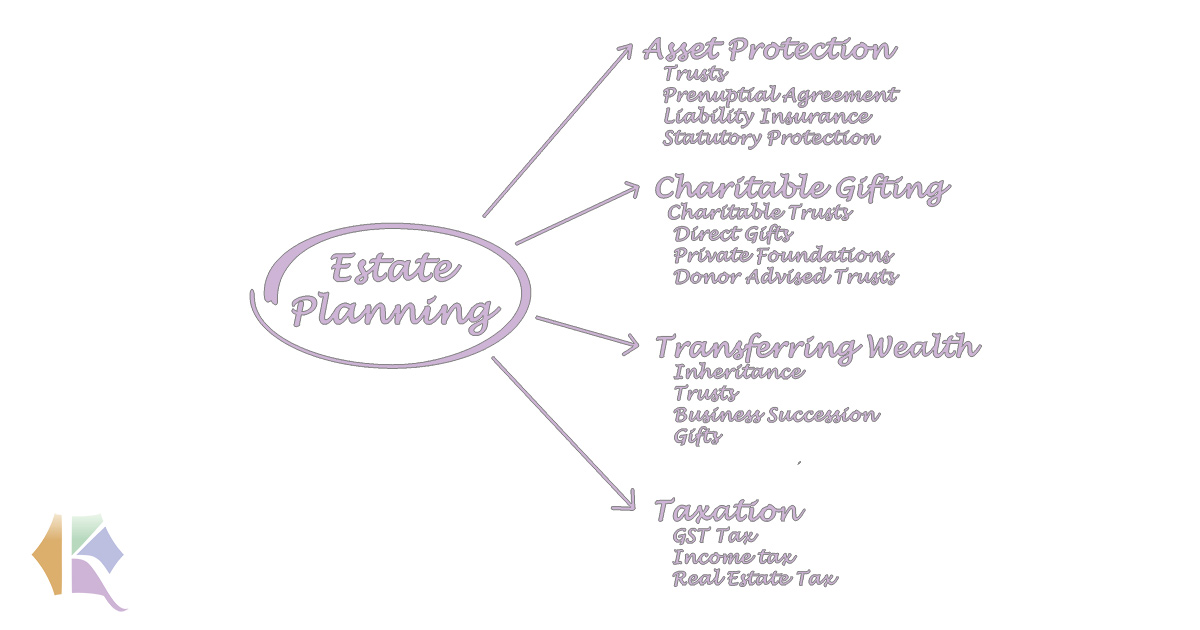

When it comes down to it, the process of setting up a charitable remainder trust is just like every other part of estate planning. You need to work with professionals to make sure your goals are accomplished. You need to think about what you want and build your estate plan appropriately. The government gives you avenues within tax codes and legal devices to accomplish most of your goals. You just need to plan wisely and that includes benefiting your favorite charity.