Power of Attorney

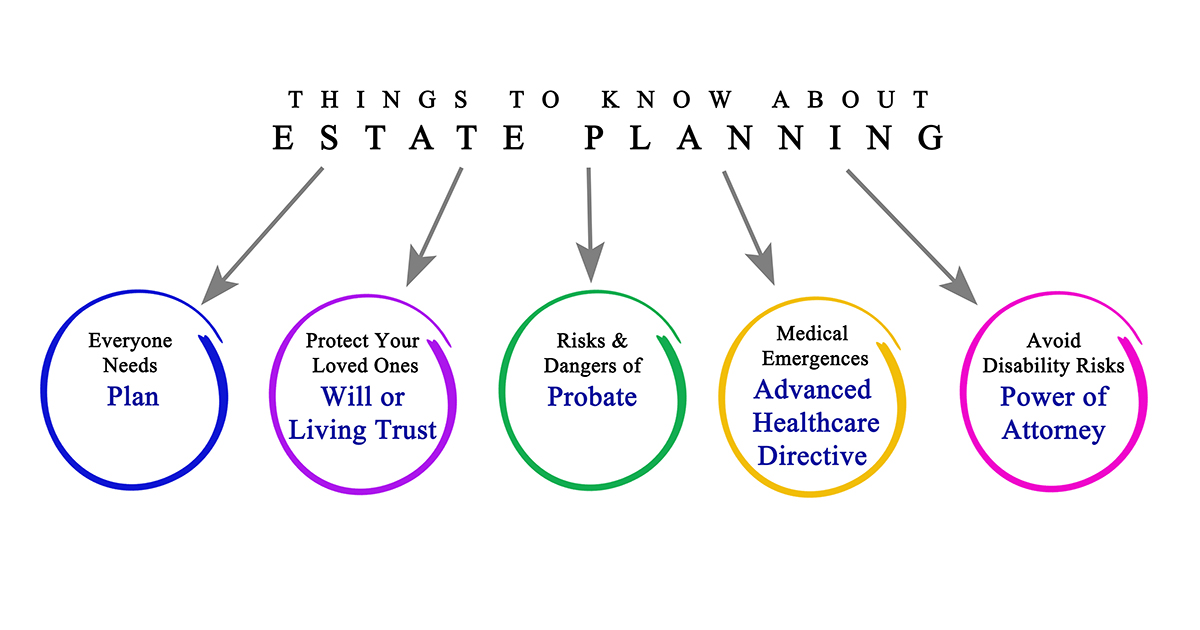

In our last blog, we talked about the importance of a health care directive in the context of the COVID-19 world that we are living in. Additionally, we want to talk about another part of your estate plan, the financial power of attorney. We talk about these two documents together because they are useful while you are still living, opposed to your will and/or trust which are useful after you pass away.

To be sure, COVID has made planning more prevalent for a lot of people, but that doesn’t mean that when the virus is gone, we should forget about it. COVID is top of mind for many of us, but tragedy can strike at any moment. You could be in a car accident or have a heart attack or get struck by lightning and be stuck in the hospital for months. Frankly, the cause is irrelevant. What matters is that you have planned beforehand, so that your loved ones can take care of your matters while you aren’t able to take care of them.

The financial power of attorney allows someone, called the “attorney-in-fact”, to speak and act on your behalf. Imagine you are in a car accident that leaves you with severe injuries and lands you in the intensive care unit. Unfortunately, the companies that you do business with won’t cease their operations. If you owe them money, they are still going to ask for it. Your mortgage won’t go away. Your electric bill will keep coming. For that matter, Netflix will continue to take money out of your account. What the power of attorney allows is for someone else to be able to keep paying the bill if you want or shut off the account if it is not needed.

Something that may be a bit more important than Netflix or your cable is that your attorney-in-fact can work with your insurance companies on the claim on your car. Or they can work with your disability insurance company to make sure that money continues to get paid to you. The goal is for the attorney-in-fact to keep your life moving so that when you get out of the hospital, you can go back to life and not have to dig out of past due bills or spend time where to start financially.

The reality is that tragedy does strike people. Some of us will get hit harder than others. Some of us will need to leave a roadmap for our loved ones on how you want your affairs handled if you are incapacitated. We always recommend that you plan to make sure that your wishes are considered. We don’t want people guessing what we might want or doing what they think is best for us. Their intentions are good, but what you want is what matters. Financially, a power of attorney is how you explain what it is that you want.