Updating Your Titles, Deeds and Beneficiaries

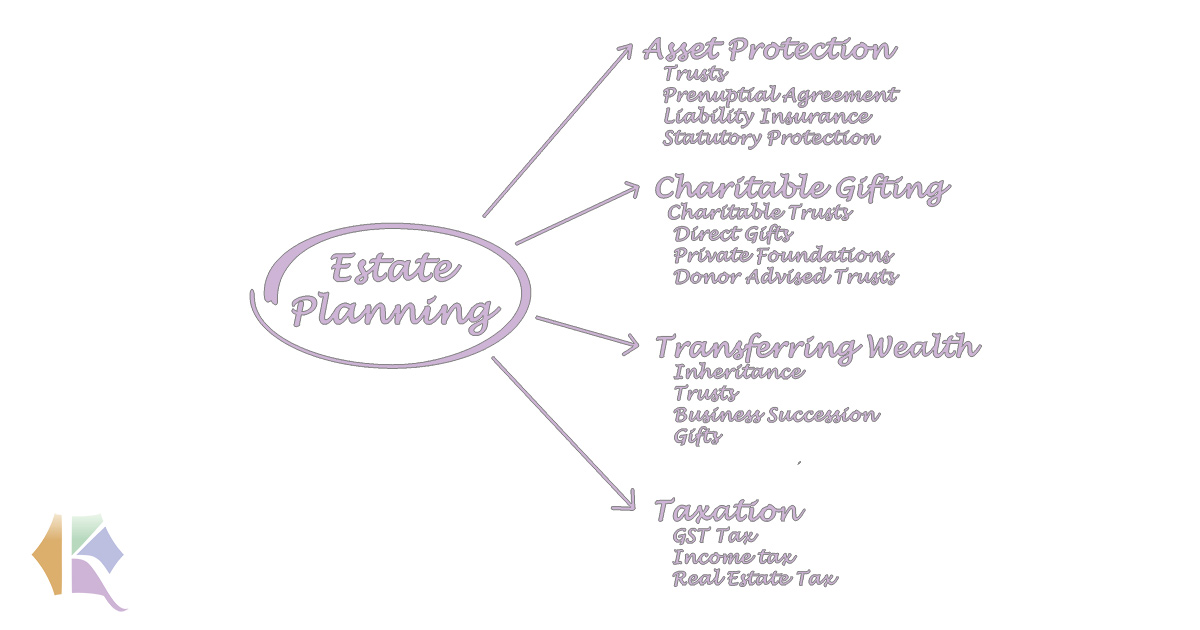

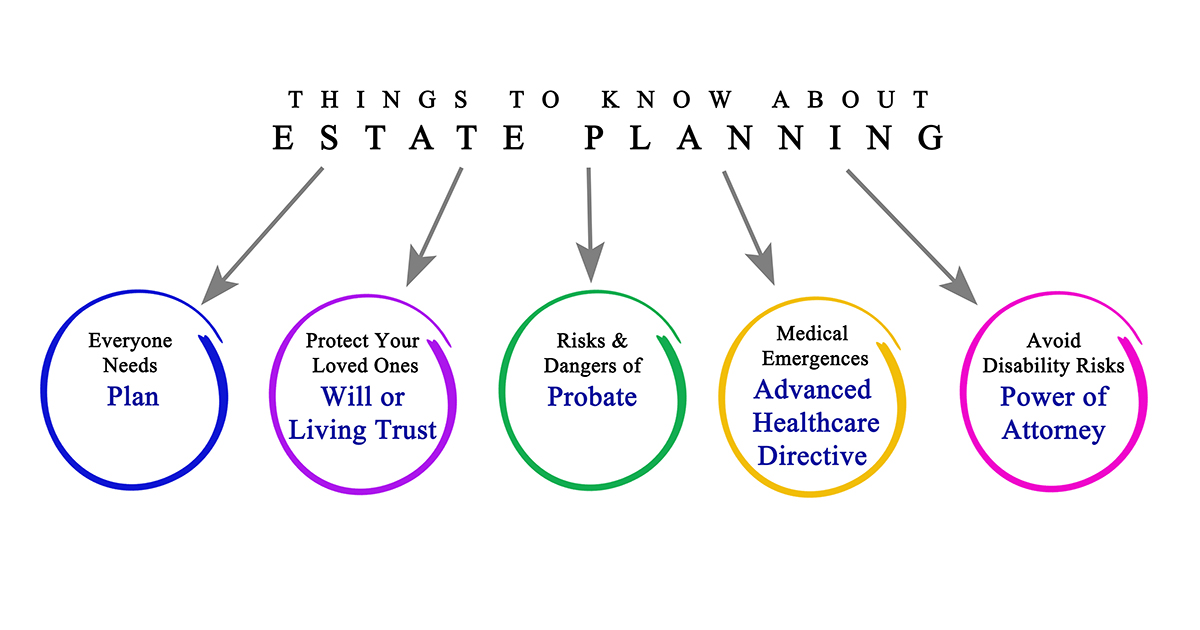

Many times, when people think about estate planning, they think only of their will and trust. We have tried to educate people on why they need to plan for other situations as well.

Yes, your will and trust help you when you die, but what about when you are still alive and just need a little bit of help. You need to think about your health care directive and your financial power of attorney. Earlier this month, we debuted A Guide to My Life: My Advisors, Digital Assets and Documents which is a guide to help you keep track of your online life that helps your loved ones keep your affairs in order in life and death. There are many, many other facets to estate planning, but today we cover why you need to update the deeds and titles of your assets and the beneficiaries of your financial accounts. Each of those need to be covered separately.

First, let us talk about the deeds on your housing properties. Typically, clients want to avoid probate courts as much as they can so that their loved ones avoid the headache that comes along with it. The stage in life that you currently reside, and your unique situation will make a bit of difference, but as a rule of thumb a Transfer on Death Deed (TODD) is an essential part of your estate plan. For most people, their house is the most valuable asset that they possess, and it is one that many times will drive their estate into probate when they pass away.

So, what does a TODD do? A TODD simply is a type of deed that takes your house and transfers the ownership of the property to a specified person. That means you keep the ownership of the house to yourself and when you die, it goes to your children or some other person rather than a court deciding what happens during the probate process. You then file the deed with the county (usually in the land records department). When you die, your house automatically passes on to the next person with out going through the process. It really is as simple as that.

Some people may have extremely valuable vehicles or boats. You can do the same thing with those assets as well. When it comes to large assets, you can put transfer on death designations on vehicles with the DMV and on boats/yachts with the DNR. They work in the same way as a Transfer on Death Deed with your house.

The last thing we want to talk about is beneficiaries on your financial accounts. This includes everything from your life insurance to your 401(k) to your savings accounts at your bank to your checking account. You want to make sure there is a beneficiary listed. Why you may ask? It is simply to ensure your assets get transferred to the right person or entity. Again, this is a great way to avoid the probate process. Say you are 40 years old and you have $100,000 saved in an IRA, you may want to put your spouse on the account as a beneficiary. That means that there is no need to go to the probate court to decide who gets it. In most cases your spouse would gain access to it anyway if you didn’t designate the beneficiary, but it could take months or years for that to happen and the value of it would likely be substantially decreased because you would have to pay fees to courts and attorneys. In another scenario you may set up a trust for your kids if something happens. If the beneficiary does not get labeled correctly, your accounts again go through probate and your children will not be taken care of the way you want.

The message is simply this, the little things make a difference. The cost is either extraordinarily little or nothing to do these things, but not completing them can be extremely costly and time consuming.